The Much (and Long) Awaited Fed Rate Cut is Here

The Fed started the rate cut cycle off with a decisive 50 bps cut in an 11-1 vote. The cut came in slightly larger than expected, with markets pricing a 62% probability of the Fed delivering a 50 bps cut, rather than a 25 bps. The move signifies an aggressive pivot by the Fed to a policy aimed at bolstering the US labor market. “This decision reflects our growing confidence that with an appropriate recalibration of our policy stance, strength in the labor market can be maintained in a context of moderate growth and inflation moving sustainably down to 2%,” Fed chair Jerome Powell said in his presser.

In the world of real estate, there’s a common misconception that mortgage rates will automatically drop by 50 basis points (bps) the moment the Federal Reserve cuts its rates. However, this isn’t how the financial markets operate. It’s important for consumers to understand that the bond and rate markets are constantly updating in real-time, influenced by changing expectations and market sentiments—not just by actual rate changes.

The Real-Time Nature of Rate Markets

At present, for example, investors are already analyzing polling data for the upcoming Presidential election, forming strategic views on how the election results might influence inflation, regulations, and profitability. Based on these insights, they’re executing their investment strategies now, rather than waiting for the official election results in November. This proactive approach highlights how markets are forward-looking, often reacting to expected future events rather than current ones.

What Does This Mean for Mortgage Rates?

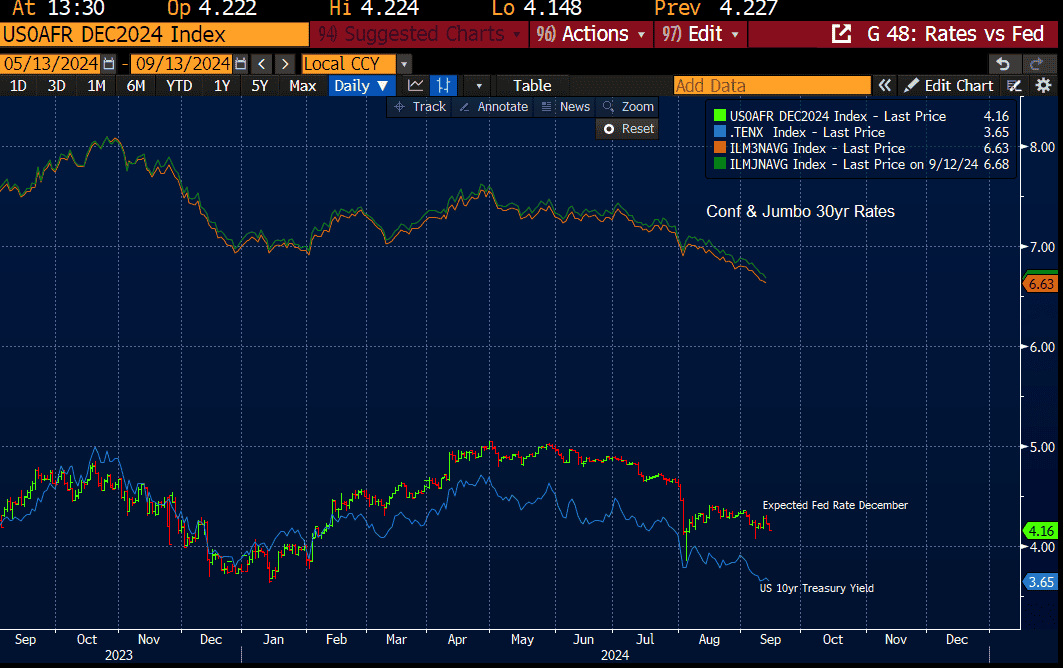

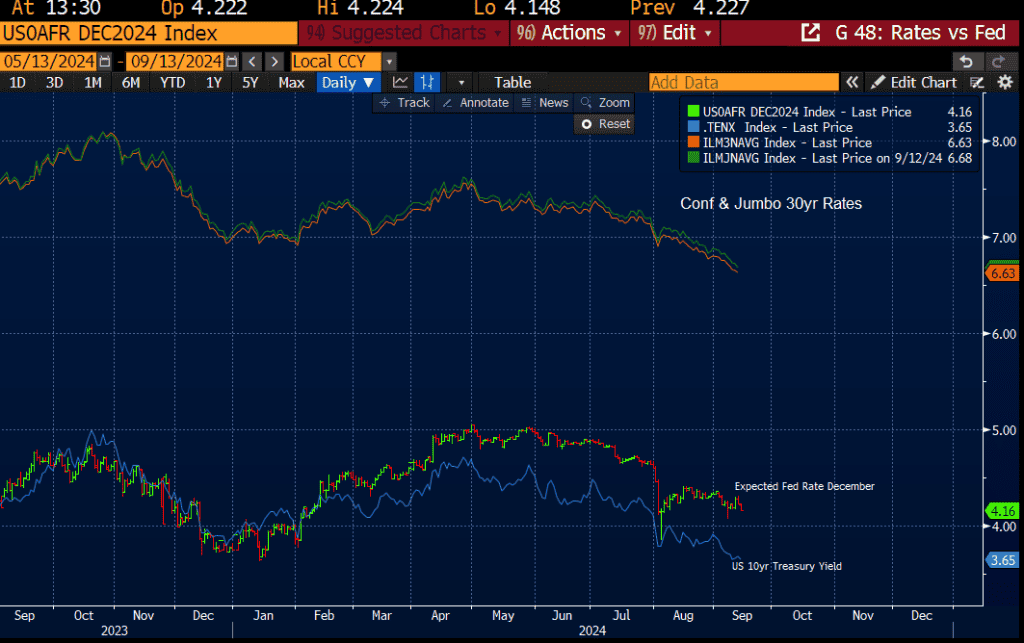

In all, there will be 100bps of rate cuts expected by the markets for the remainder of 2024. So, what are mortgage rates going to do? Likely NOTHING – it’s ALREADY happened! From April to now, the expected Fed rate at year end dropped by 100bps, give or take. In that same period, the average 30yr rate on jumbo and conforming mortgages dropped by about…….**drumroll**…..100bps. The yield on the US10yr note also fell by 100bps, going from 4.70 to 3.70.

Graph Courtesy of Cory Cassle, Origin Point

The Key Takeaway

In essence, don’t expect any major changes in mortgage rates solely because the Fed announced a 50bps rate cut. The markets have already priced in those expectations. What will be more crucial is the Federal Reserve’s corresponding statement and Jerome Powell’s Q&A session following the rate announcement. The direction of future mortgage rates will be more influenced by the Fed’s macroeconomic outlook and forward rate guidance than by the rate cut itself.

Managing Expectations

Understanding these dynamics can help manage expectations—both for industry professionals and consumers. It’s not about waiting for the Fed to act but understanding that markets move ahead of time, based on expected outcomes. By staying informed and aware of these market movements, you can make more strategic decisions in the real estate market.

If you have any questions about how these market trends might affect your buying or selling decisions, or if you’re looking for off-market opportunities, call me today! I’m here to guide you through the complexities of the market with the expertise and personal attention you deserve.

Kelly Perkins

Principal REALTOR®

DRE#: 01932146

949.310.3754

kellyperkins@compass.com