Understanding Real Estate Market Dynamics

There’s so much chatter everywhere recently about bubbles bursting in the real estate market. Picture that. I remember as a kid blowing bubbles—they’d get bigger and bigger, and the joy of them growing was intoxicating. I could not stop myself. BIGGER! And then… POP! The bubble burst, and my addictive nature led me to try again. Yes, bubbles burst—kids’ soap bubbles, not real estate.

Real Estate as a Hard Asset

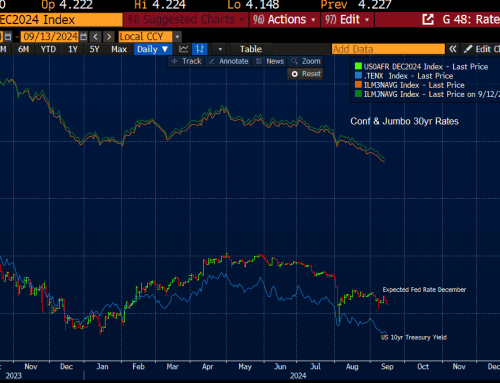

Real estate is a hard asset. Hard assets can increase and decrease in value over time. We have witnessed some massive increases in the past few years, fueled by inflation, under-supply, under-building, demographic shifts and adjustments, massive wealth creation, etc. Some of this was natural and expected, although a bit delayed. Some of it was artificially fueled by extremely low rates held low too long. Some of it was speculative. Some of it was fueled by increased corporate-style thinking around ownership.

The Balloon Analogy for Real Estate

But think of real estate—especially homes, an essential need—as more of a balloon than a bubble. Some cycles inflate that balloon, and others deflate it. And most importantly, every home—if we think of it as a balloon—is different. Never forget that all markets and homes and areas and neighborhoods are different. Averages are often useless data. Real estate is HYPER-localized.

The Value of Hyper-Localized Real Estate

A little deflation after massive inflation may serve us all well, especially those who argued that once prices are up, they can NEVER go down. They are wrong too. But the words of my Dad ring truer today than ever as it relates to homes: “A brick is a brick!” Other assets have the capacity to burst and leave behind mere fragments and traces—not homes.